Market Overview

ASX 200 Index

Weekly Wrap: AI Margin Squeeze Hits Software Peers as ASX Slips, Yet Week Ends Higher

ASX slips 1.4% as AI fears squeeze software margins; yet the week climbs 2.4% on bank strength and gold rebound.

Weekly Wrap: ASX 200 slides 2% as froth indicators deepen global pullback

ASX 200 skids 2% as Bitcoin froth indicators fade and AI concerns weigh on tech and miners; weekly loss 1.8%.

Weekly Wrap: Late pullback slams gold shares

ASX slips 0.7% as late pullback drags gold shares lower on Fed chair speculation; bullion drops ~5% amid rate-hike fears.

Weekly Wrap: Rising rates lift AUD and gold as miners lead ASX gains

Gold hits fresh highs and miners rally as rates rise; Life360 soars on upbeat guidance, AUD hits 16-month peak, ASX 200 slips 0.5% for the week.

Weekly Wrap: ASX slips on war fears as earnings beat expectations buoy week

War fears nudge ASX 200 lower despite QBE's 21% profit surge; energy gains lift oil names, tech slumps; Guzman sinks below float.

Weekly Wrap: Markets edge as Rio-Glencore talks spark change in mining bid

Rio Tinto slides 6% on Glencore all-stock merger talks; BlueScope up 2% after rejecting a $30 offer. ASX 200 drifts -0.1% as deal news dominates.

Anglo American sells nickel assets to MMG as part of strategic refocus

Anglo American has sold its nickel arm for US$500m to a Singapore-based subsidiary of MMG as part of a plan to tighten its business. The company’s nickel business comprises two ferronickel operations in Brazil – Barro Alto and Codemin – and two large greenfield growth projects, Jacaré and Morro Sem Boné. The Barro Alto mine, […]

Cornish Metals secures £28.6 million government investment to restart historic South Crofty tin mine

The UK’s National Wealth Fund (NWF) has announced a £28.6 million direct equity investment into Cornish Metals (TSX-V: CUSN) to help finance and de-risk the re-opening of the South Crofty tin mine in Cornwall. The fully-permitted underground development hosts one of the world’s highest-grade tin resources and racked up more than 400 years of recorded […]

Cameco and Kazatomprom suspend Inkai operations amid regulatory delays, boosting uranium prices

The global uranium price improved after the giant Inkai joint venture operations in Kazakhstan were suspended due to a delay in receiving key government approvals. Canada’s Cameco (40%) confirmed the shutdown of production activity at the JV operation after being informed by partner Kazatomprom (60%) that the in-situ recovery JV failed to receive an extension […]

Base Resources receives $375m takeover bid from Energy Fuels to create global critical minerals group

US-based critical minerals producer Energy Fuels has made a takeover bid for Australian company Base Resources (ASX: BSE) to create a billion-dollar global business with a focus on rare earth elements, uranium and mineral sands production. Under the terms of the proposal, Base shareholders will receive 0.026 Energy Fuels shares for each Base share held […]

Poolbeg Pharma moves closer to granting of patent for POLB 001 to treat multiple diseases

UK biopharmaceutical company Poolbeg Pharma (AIM: POLB) has received a notice of allowance from the US Patent Office in relation to an application for its lead candidate POLB 001 in the treatment of multiple diseases. The notice covers a class of drugs (including POLB 001) for treating hypercytokinaemia (cytokine storm) and for preventing its development […]

Faron Pharma reports improved remission rates from Bexmab Phase 1 trial to treat patients with aggressive cancers

Faron Pharmaceuticals (LSE: FARN) has reported positive data from Phase 1 of an ongoing trial investigating bexmarilimab (Bexmab) in combination with standard of care in aggressive hematological malignancies of acute myeloid leukemia (AML) and myelodysplastic syndrome (MDS). Four out of five initial Phase 1 patients have now been on Bexmab with azacitidine for more than […]

Ondine Biomedical’s Steriwave antimicrobial to be rolled out in eight new healthcare facilities

Ondine Biomedical (LSE: OBI) has announced that its Steriwave nasal photodisinfection and chlorhexidine skin decolonisation technology will be deployed in eight new healthcare facilities worldwide, including six hospitals. The commercial deals are paid adoptions which had begun or were agreed to before the end of February. The first three are at hospitals in Spain and […]

AstraZeneca spends US$1.05b to acquire Amolyt Pharma and boost its rare disease portfolio

Global pharmaceutical company AstraZeneca (LSE: AZN) will part with US$1.05 billion to buy-out French biotech Amolyt Pharma, which is focused on the development of novel treatments for rare endocrine diseases. Under the terms of the transaction, AstraZeneca will acquire all of Amolyt’s outstanding shares on a cash and debt-free basis. It will include an US$800 […]

Keywords Studios sees revenue jump following strategic acquisitions

Irish video game service provider Keywords Studios (LSE: KWS) has cited robust organic growth and multiple acquisitions for a 13% jump in 2023 full-year revenue to approximately £666 million, from £590 million in the previous year. The company’s adjusted operating profit rose 6% to £104 million with a 15.6% margin, which was ahead of its […]

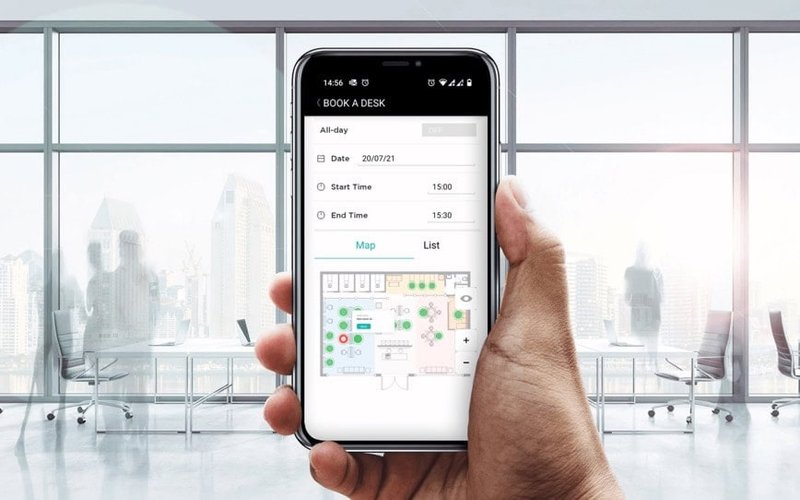

Sign In Solutions makes £28.35m cash bid for SmartSpace Software

Sign In Solutions subsidiary Welcome UK Bidco has made a £28.35 million cash offer for technology business SmartSpace Software (LSE: SMRT) by way of a court-sanctioned scheme of arrangement. SmartSpace designs and builds smart software solutions such as visitor, desk and meeting room management to help transform employee engagement. Under the terms of the deal, […]

IQE executes multi-year agreement with global consumer electronics leader

United Kingdom semiconductor company IQE (LSE: IQE) has entered into a multi-year strategic agreement with an undisclosed “global consumer electronics leader” based in Asia. The agreement is focused on the high-volume production of vertical-cavity surface-emitting lasers (VCSELs) for advanced 3D sensing applications, and highlights the company’s push to expand into Asia. It will also focus […]

Kape Technologies’ ExpressVPN launches first ever Wi-Fi 6 router with built-in VPN protection

Leading cybersecurity company Kape Technologies’ (LSE: KAPE) subsidiary ExpressVPN has announced the launch of the first Wi-Fi 6 router with built-in VPN protection, called Aircove. The Aircove router marks the first of ExpressVPN’s hardware releases, aiming to protect customers’ devices at home including computer and laptops, smart TVs and other internet of things (IoT) devices. […]

Diversified Energy to lift interests in US oil and gas assets

London and New York-listed Diversified Energy Company (NYSE: DEC) has entered into a conditional agreement with Oaktree Capital Management for the strategic acquisition of working interests in a number of operated assets in the Central Region of the US. The US$386 million acquisition will consolidate Diversified’s working interest in its existing operated wells in the […]

Irish Government eyes off SSE Thermal’s Tarbert power station for emergency generation

SSE Thermal (LSE: SSE) reported the Irish Government is eyeing off its Tarbert power plant as a potential site for the nation’s emergency generation in the near future, if required. The thermal power generation company, which is a subsidiary of SSE, confirmed the news in a recent announcement – indicating it has been in talks […]

BP to buy US renewable natural gas company Archaea Energy in US$4.1b deal

Multinational oil and gas giant BP (LSE: BP) has announced plans to acquire renewable natural gas (RNG) company Archaea Energy (NYSE: LFG), in a deal estimated to be worth US$4.1 billion. RNG, otherwise referred to as biogas, is generated from organic waste in landfills of farms. The deal between BP and Achaea marks the largest […]

Cameco partners with Brookfield in acquisition of Westinghouse Electric

Canadian uranium giant Cameco Corporation (NYSE: CCJ) and clean energy investor Brookfield Renewable Partners (NYSE: BEP, BEPC) have announced they will join forces on the acquisition of global nuclear services business Westinghouse Electric Company. The acquisition gives Westinghouse a total enterprise value of almost $8 billion. Under the arrangement, Cameco’s expertise in the nuclear industry […]

Mike Ashley joins Hornby as consultant amid Frasers Group’s increased stake

International models and collectibles group Hornby has engaged retail tycoon Mike Ashley as a consultant to the company. The appointment comes one month after it was revealed that Mr Ashley’s company Frasers Group had upped its stake as a strategic shareholder. Mr Ashley will provide the services to the toy company through his wholly-owned company […]

Vodafone Group to divest Italian business in US$8.71b deal with Swisscom

Vodafone Group Plc (LSE: VOD) has announced it will divest its subsidiary Vodafone Italy to Switzerland-based telco Swisscom AG. The US$8.71 billion transaction follows an extended period of engagement with several companies to explore market consolidation options in Italy. It comes hot on the heels of Vodafone Spain’s divestment in October to Zegona Communications plc […]

China’s JD.com becomes second suitor to walk away from takeover bid for Currys

Chinese e-commerce giant JD.com (also known as Jingdong) has walked away from a takeover tussle for British appliance and electronics chain Currys plc (LSE: CURY). In a brief statement released last week, the company said it would no longer pursue an offer for the High Street brand, less than one month after entering the race. […]

NetScientific reports profitable year ahead of shift in venture capital trends to deep tech

Deep tech and life sciences venture capital investment group NetScientific plc (LSE: NSCI) has lodged a proprietary trade profit of approximately £427,000 and an increase in capital under advisory to £23.5 million for the year ended 31 December. The group – which has a portfolio of 23 companies — also reported the raising of £52.2 […]

Never Miss a Market Move

Get the latest ASX small-cap news, exclusive CEO interviews, and market insights delivered to your inbox.

Free weekly newsletter. Unsubscribe anytime.